By Alejandro A. Tagliavini *

The rise in inflation at the global level will undoubtedly affect Argentina, although its internal problems are much more serious. It turns out that the astronomical fiscal programs provided by the most powerful economies are inflating global prices significantly. The rise in the CPI (a consequence of inflation) in the US during May reached 5% year-on-year, a lot for a developed country and, without a doubt, this is just beginning. Although, on the other hand, the slowdown in economic growth will cause a certain drop in prices (the CPI) despite the increase in inflation (intrinsic devaluation of the currency due to excess issuance).

As seen in the table, the real rates are negative. Even so, the Fed says it is surprised by «the rapid recovery of economic activity» and warned that it would keep its reference interest rates close to zero until the employment level returns to normal, which today is close to 5.8%, 2 percentage points above the record prior to the beginning of the repressions with the excuse of «the pandemic.» Although all analysts expect the rate hike to be brought forward by 2023, to «curb inflation.» The truth is that what they are concerned about is the rise in the CPI, which at a global level is driven by factors such as these two of great weight: the unprecedented increase in the Fed’s balance sheet (Fed BS) of USD 200,000 M only in last month, and China’s marginal indebtedness on the way to record:

As can be seen in the following graph, the issuance of the main central banks is accelerating:

For those who still doubt that issuance – as exceeds demand – is inflationary, in this graph you can see how the S&P 500 and house prices closely follow the Fed Balance:

And here is how global stocks rise to the pace of global issuance:

Corollary: there is not a bubble in the stock markets but inflation and, therefore, other than a correction to the tremendous upward rally and due to the slowdown in economic growth, bottom prices are unlikely to fall. Of course, I don’t see «a rapid recovery of the economy» as the Fed says, but an increase in output prices due to inflation.

Thus, the increase in the prices of raw materials has taken a significant leap, as seen, for example, in hot rolled coils, rhodium and palladium, PVC and BDI (freight):

As for Argentina, as Roberto Cachanosky points out, in the following table, so far this year the Monetary Base has been frozen. Thanks to the real lowering of public spending due to inflation and at the cost of increasing the debt of the BCRA at a forced march:

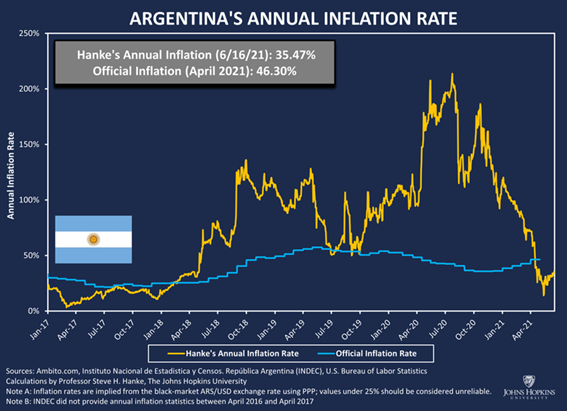

This has caused, as I have been saying in previous notes, that inflation – the intrinsic devaluation of the peso due to excess issuance – has stopped, which was reflected in the purest mirror, the “blue” dollar (the «illegal», and so, without government controls), that now it seems to be waking up precisely because they would be starting to issue, and it is very likely that from now on pesos will be released onto the market due to the election campaign and, then, the inflationary process will overheat. Thus, the most credible measure of inflation is the one calculated by Steve Hanke based precisely on the “blue” dollar:

Although May was a new month in which the «general level of inflation» – the rise in the CPI, strictly speaking – contracted compared to the previous one, 3.3% continues to be a high figure:

Although Cachanosky sees it differently: annualized, the curve goes up and is already at 48.8% per year May 21 vs. May 20:

In any case, although inflation was controlled – I insist, excess issuance – during the first months, the CPI continued to rise inertially, until now that it seems to have fallen in month-on-month terms.

This is due to the government’s strategy to precisely delay the rise in the CPI, despite inflation, with subsidies to keep tariffs behind, frozen prices, slowing the increase in the official exchange rate and intervening in parallel markets. And, by the way, as we saw, the issuance was largely stopped with debt, taking funds away from the private sector, the productive sector, and in the face of lower production, ironically, prices increase the CPI. A clear index of the decapitalization of the Argentine market is the value of the apartments that, according to Reporte Inmobiliario, in the last year fell on average by 27.17% in US dollars, and if you take the last 24 months the fall in values already reaches 39.53% on average.

Consistently, apartment rental provide an Annual Internal Rate of Return (IRR) of:

The government still has the resources to go ahead with this repressive exchange rate policy, which is helped by the dollar inflation that we saw. We need to see how events unfold after the November mid elections when the government will not feel the need to control «inflation» erroneously attributed to the rise of the dollar, when it is the other way around, and if there is an agreement with the bureaucrats of the statist IMF which can lower the pressure on the official dollar.

As Cachanosky points out, the MSCI rating that almost says that Argentina does not exist for the financial market should come as no surprise. With net reserves of USD 3,000 M, the Central Bank of Argentina (BCRA) should back the monetary base and the stock of Leliq -debt bonds- and net repos for $ 6.2 T. In other words, the BCRA has one dollar for every $ 2,067 of monetary base and remunerated debt.

And although the government still has the resources to maintain the official exchange rate until the elections at least, it is careful to spend reserves to the point that it comes in handy to ban most international flights – leaving many Argentines stranded abroad – with the excuse of a «pandemic» promoted by official bodies, such as the historically corrupt WHO, the US CDC or the British NHS, which does not stand up to the analysis of independent scientists (1), with the logical result of panic and violence: the destruction of society and production. Let’s just hope that these restrictions on the mobility of Argentines are not an enclosure in the style of impoverished Cuba.

Speaking of a drop in production, according to the official statistics bureau INDEC, during the first quarter of the year general economic activity rose 2.5% year-on-year. However, the last «normal» quarter had been the quarter of 2019 and comparing it with the first of quarter 2021 it is observed that the economy is still below. By case, the employment rate fell from 42.2% to 41.6%, which implies that some 65,000 jobs were lost.

Even with a supposed worsening of the health care situation, for the moment the government does not seem willing to implement more repressive measures -on a market that was already very repressed during the previous administration- that will again damage the economy in a magnitude similar to that of 2020 which is a tacit recognition – although for obvious reasons the government will never recognize it – that violence – repression – and panic can only destroy.

Now, among the strong repressions on the market that seems to continue is the tax burden. For example, according to FADA, the tax burden on the agricultural sector is 61.8% and not only is this value in itself extremely exaggerated, but it also does not take into account the “cascade effect”, that is, when the producers buy any input they pay a price that is such, not only because of the cost of production of that input, but also because it includes an amount of taxes that the producer of that input in question pays.

And the situation of the Argentine «golden goose», the agriculture sector, may worsen because the prices of raw materials have been going through an upward cycle that resulted in products such as oil or soy are at record values, but there are indications that they could be saturated -except for oil- given that the growth of the economies, with so much injection of inflationary money, could slow down.

In fact, the following table by Zorraquín Meneses based on MATBA / Rofex quotes shows a significant drop:

NOTES:

(1) In almost two years, deaths are attributed to Covid by less than 0.1% of the global population and the figure is exaggerated, because deaths from other causes are added and because the protocols and treatments, recommended by these official bodies, are completely counterproductive. As for infections, the normal in a flu season reaches 60/70% of the population.

*Senior Advisor, The Cedar Portfolio

1 Pingback